22M1整体市场表现依然平淡,环比有所改善

文件列表(压缩包大小 1.98M)

免费

概述

2022年02月18日发布

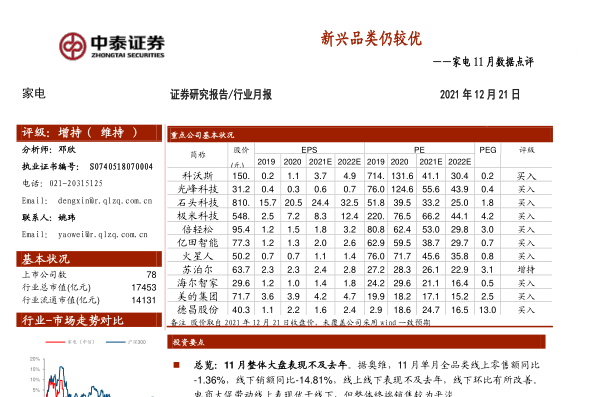

22M1家电零售市场表现依然平淡,环比21M12有所改善。22M1线上销额/销量分别同比下降7.23%/下降18.03%,22M1线下全品类销额/销量分别环比下降20.68%/下降26.81%,1月零售数据仍然平淡,与春节错期效应有一定影响,但市场需求仍受多地疫情反复、地产数据偏弱等原因影响较大;但相比21M12,今年1月的零售数据有较为明显的改善,21M1线上销额/销量分别环比增长8.58%/增长12.05%,线下销额/销量分别环比增长12.69%/增长25.91%。

大家电:线上表现好于线下,干衣机品类表现较好。22M1空调/冰箱/洗衣机/彩电/干衣机线下渠道零售额分别同比-29.53%/-15.95%/-24.13%/-19.24%/+24.45%,均价分别同比上涨+6.99%/+14.02%/+2.39%/+18.32%/+5.92%;线上渠道零售额分别同比变化-20.43%/+6.72%/-2.32%/-8.27%/156.75%,均价分别同比变化+7.51%/+2.49%/+2.39%/-6.66%/+14.69%,冰箱、冰柜1月线上增速持续回暖,干衣机均价提升明显。从市占率角度来看,空调品类,22M1美的/格力/海尔线下市占分别为35.28%/34.64%/15.00%,同比-1.01pct/+0.48pct/+1.33pct;美的/格力/海尔线上市占分别为36.27%/28.63%/9.88%,同比+4.17pct/+0.11pct/-3.03pct。

厨电:传统厨电品类增速承压,集成灶领跑行业。22M1油烟机/燃气灶/集成灶/燃气热水器/洗碗机线下渠道零售额分别同比-22.30%/-14.69%/+6.50%/-42.63%/-1.46%,均价分别同比上涨5.90%/4.86%/12.95%/2.67%/3.66%;线上渠道零售额分别同比-6.37%/-8.19%/-8.80%/-20.06%/-6.09%,均价分别同比+7.42%/+7.82%/+25.46%/3.87%/3.66%。从市占率来看,亿田/火星人/美大线下市占分别为2.83%/26.28%/15.05%,同比+0.39pct/+3.21pct/-2.47pct;线上市占分别为24.08%/15.13%/8.33%,同比+2.09pct/+9.31pct/+3.47pct。

小家电:21M1传统小家电增速环比向好,清洁电器仍保持较高景气度。22M1电饭煲/破壁机/养生壶/料理机/扫地机器人线下渠道零售额分别同比-5.69%/-30.52%/-16.53%/-30.06%/+2.51%,线上渠道零售额分别同比变化-9.70%/-16.59%/-24.32%/-14.20%/+20.44%。环比来看,22M1电饭煲/破壁机/养生壶/料理机/扫地机器人线下渠道零售额分别环比+67.98%/+11.16%/+42.23%/+14.56%/15.49%;22M1电饭煲/破壁机/养生壶/料理机/扫地机器人线上渠道零售额分别环比+21.49%/-9.31%/-8.03%/+2.91%/+5.32%。扫地机品类中,22M1科沃斯/美的/莱克线下市占分别为87.98%/6.67%/0.38%,同比+3.26pct/+2.36pct/-1.35pct;科沃斯/云鲸/石头线上市占分别为41.03%/16.58%/18.84%,同比-2.54pct/7.39pct/8.26pct,云鲸较上月市场份额环比下降0.59%。

投资建议

家电零售市场表现依然平淡,但环比21M12有所改善,线上零售表现总体优于线下,其中传统家电整体表现偏弱,新兴品类表现较好。建议关注:美的集团、海尔智家、科沃斯、石头科技、火星人、亿田智能、老板电器。

风险提示

疫情影响宏观经济未达预;家电行业价格战加剧;地产表现低迷;原材料价格上涨风险等

理工酷提示:

如果遇到文件不能下载或其他产品问题,请添加管理员微信:ligongku001,并备注:产品反馈

评论(0)

0/250

理工酷

理工酷

资源下载

资源下载