22M2线下零售复苏缓慢,原材料价格压力仍在,均价同比上涨

文件列表(压缩包大小 2.05M)

免费

概述

2022年03月17日发布

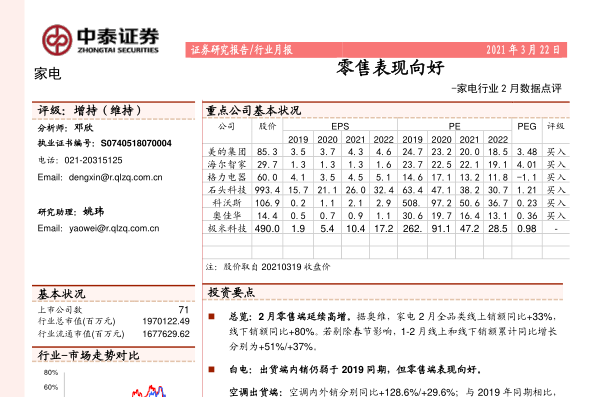

22M1-2家电零售市场表现较弱,线上略好于线下。22M2线下、线上合计销额分别同比下降10.55%,增长10.14%,1-2月线下、线上累计分别同比下滑17.79%、下滑1.45%。2月家电全品类线下、线上合计销量分别同比下滑29.51%、上升2.19%,环比1月分别下降48.18%、下降36.3%,2月合计同比分别下滑27.80%、下滑11.19%。线下零售市场仍受多地疫情反复、地产数据偏弱等原因影响较大。

大家电:干衣机品类表现较好,线上表现优于线下。22M1-2累计数据显示,空调/冰箱/洗衣机/彩电/干衣机线下渠道零售额分别同比-7.23%/-18.45%/-19.44%/-22.66%/+42.69%,均价分别同比上涨+7.63%/+14.81%/+9.73%/+18.98%/+4.36%;线上渠道零售额分别同比变化+28.24%/-1.42%/+5.38%/-10.85%/+164.23%,均价分别同比变化+11.57%/-0.56%/+2.48%/-7.99%/+4.61%。从市占率角度来看,空调品类,22M1-2美的/格力/海尔线下市占分别为33.71%/32.88%/15.53%,同比-3.00pct/+0.86pct/+0.75pct;美的/格力/海尔线上市占分别为42.11%/24.63%/11.00%,同比+11.49pct/-1.17pct/-6.30pct。

厨电:集成灶、洗碗机表现较好,线上表现优于线下。22M1-2累计数据显示,油烟机/燃气灶/集成灶/燃气热水器/洗碗机线下渠道零售额分别同比变化-14.44%/-10.02%/+26.35%/-28.6%/+21.5%,均价分别同比上涨8.87%/7.97%/13.23%/3.67%/10.49%;线上渠道零售额分别同比变化+11.57%/+4.78%/+39.01%/-2.92%/+3.95%,均价分别同比变化+9.70%/+10.15%/+31.22%/+3.05%/+6.30%。从市占率来看,线下渠道火星人/美大/方太市占率分别为27.1%/14.93%/10.29%,分别同比+5.84pct/-2.2pct/+8.55pct,方太集成类产品市占率提升较快;线上渠道火星人/亿田/美大市占率分别为23.76%/17.26%/8.03%,分别同比+3.82pct/+10.86pct/+2.75pct。

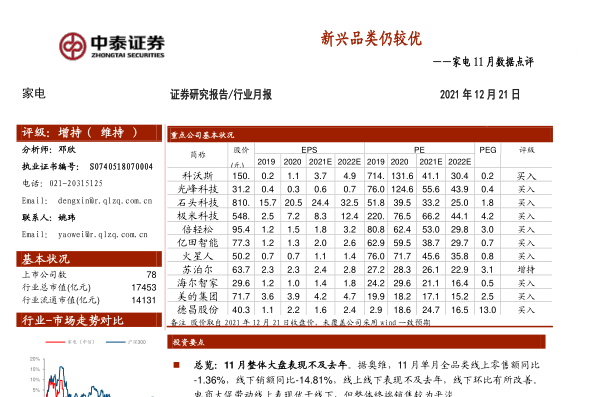

小家电:传统小家电需求仍较为疲软,清洁电器景气度有所减弱。22M1-2累计数据显示,电饭煲/破壁机/养生壶/料理机/扫地机器人线下渠道零售额分别同比变化-19.27%/-38.52%/-28.51%/-39.52%/-7.40%,均价分别同比变化+5.95%/-7.51%/-2.10%/-1.13%/+71.71%;22M1-2线上渠道零售额分别同比变化-8.53%/-14.82%/-16.66%/-14.25%/+6.50%,均价分别同比变化-0.42%/-1.11%/+2.40%/+12.50%/+58.97%。扫地机品类中,22M1-2科沃斯/美的/石头线下市占分别为85.90%/8.69%/1.33%,同比+2.16pct/+4.91pct/+1.07pct;科沃斯/云鲸/石头线上市占分别为41.33%/14.91%/20.17%,同比-2.87pct/+6.63pct/+9.24pct。

投资建议:

22M1-2家电零售市场表现依然平淡,线上零售表现总体优于线下,其中传统家电整体表现偏弱,新兴品类表现较好。建议关注:美的集团、海尔智家、科沃斯、石头科技、火星人、亿田智能、老板电器。

风险提示

疫情影响宏观经济未能达到预期;海外疫情二次冲击或将影响家电出口;家电行业价格战加剧;地产表现低迷;原材料价格上涨风险。

理工酷提示:

如果遇到文件不能下载或其他产品问题,请添加管理员微信:ligongku001,并备注:产品反馈

评论(0)

0/250

理工酷

理工酷

资源下载

资源下载